The Rise of Stablecoins in Cosmos

Why Stablecoins Matter

Stablecoins are one of crypto’s most adopted and enduring use cases. They’ve become a foundational layer for the broader crypto economy, powering payments, trading, lending, savings, and global remittances. Unlike volatile crypto assets, stablecoins are pegged to fiat currencies or real-world assets, offering price stability and accessibility to a worldwide user base.

- Market cap: ~$243.8b (May 2025), up 45× since 2019

- Market share: ~8% of total crypto market cap

- On-chain volume (2024): $27.6T, more than Visa + Mastercard combined

These metrics highlight stablecoins’ dominance in crypto adoption. In Cosmos alone, USD-based stablecoins represent over 50% of IBC’s monthly traffic, thanks to key players like Noble, Skip, Pryzm, Ondo Finance, Shade, USDT’s upcoming Stable chain, and the native interplays between these assets and Cosmos DeFi.

- Traders use them as a hedge against volatility.

- Builders use them as the unit of account in DeFi protocols.

- Users in emerging economies rely on them for dollar access.

- And institutions are exploring them for compliant, programmable money.

Cosmos: A Native Home for Stablecoins

The Cosmos ecosystem is a network of over 150 sovereign blockchains connected through the Inter-Blockchain Communication (IBC) protocol.

Since Cosmos launched IBC in 2021, the network has seen explosive growth in cross-chain transfers. In 2025, Cosmos introduced IBC Eureka, an upgrade that enables Cosmos to bridge assets directly to and from Ethereum and other major chains via light clients. This removes the need for centralized custodians and unlocks a seamless cross-chain stablecoin experience.

Why Cosmos is ideal for stablecoins

- Low-cost, fast-finality, and highly programmable interoperability with IBC — across 150+ Cosmos chains, Ethereum, and beyond.

- With IBC Eureka, enabling connections outside Cosmos to EVM, and soon L2s, and other L1s like Solana.

- Native issuance of fiat and RWA-backed stablecoins like USDC and USDY

- Composable yield infrastructure for apps to integrate interest-bearing stables.

- Developer flexibility and programmability for assets, unique to the Cosmos SDK and IBC, to tailor to regulatory and technical needs, for those who need to better configure how assets are issued and managed across chains and their users.

This puts Cosmos in a unique position to become a cross-chain financial network, making it the best place to originate, route, and settle stablecoins and RWA assets across issuers, financial institutions, and DeFi.

Let’s go over 5 projects building stablecoin products, ecosystems, and innovating on payment and capital rails over IBC.

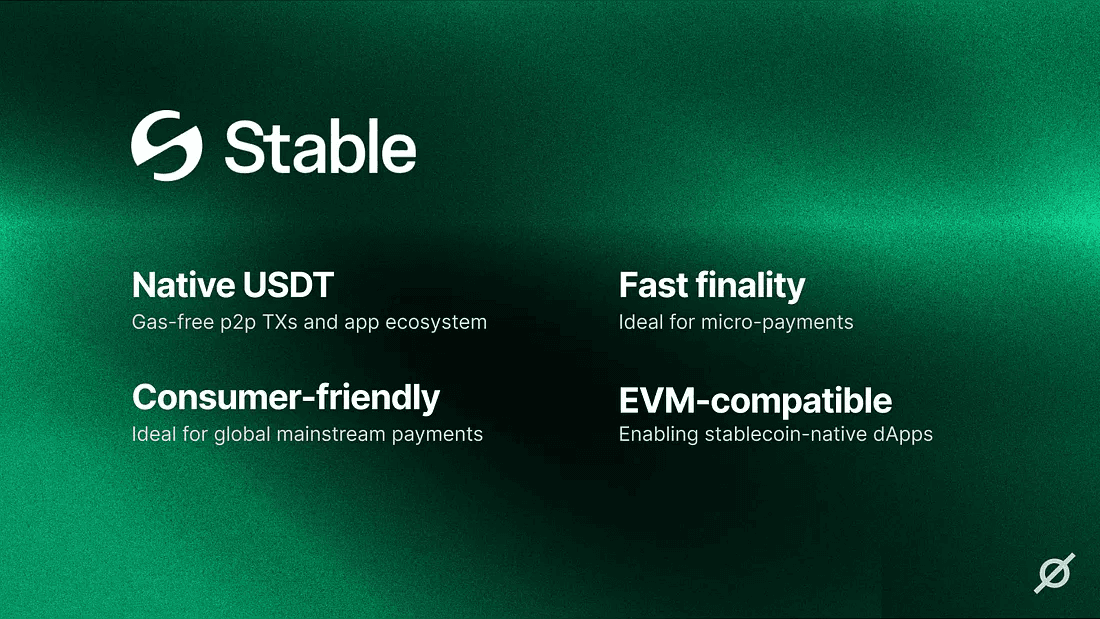

The Latest: Stable

What is Stable?

Stable is the first stablechain powered by USDT, and built on top of a customized version of Cosmos’ CometBFT and SDK. With more than $150 billion in circulation and 350 million users globally, USDT has become the most widely adopted digital dollar — powering decentralized finance, cross-border remittances, and international commerce. Stable leverages this momentum by creating a blockchain where USDT is not just supported but is native to the protocol.

Here’s what it will enable

- Native USDT gas token, eliminating the need for a secondary currency and enabling gas-free p2p transfers.

- Fast finality with ultra-low fees, making Stable ideal for both micropayments and large-scale settlements.

- High-throughput architecture supports thousands of transactions per second, ensuring performance even during peak usage.

- Guaranteed blockspace and scalable batch processing provide enterprise-grade reliability for institutional and high-volume applications.

- Full EVM compatibility and purpose-built SDKs/APIs enable developers to easily deploy stablecoin-native dApps using familiar tools.

- A consumer-friendly wallet with social login, card onramps, and readable aliases makes Stable easy to use for mainstream global payments.

Read more about the upcoming the Stable L1 chain

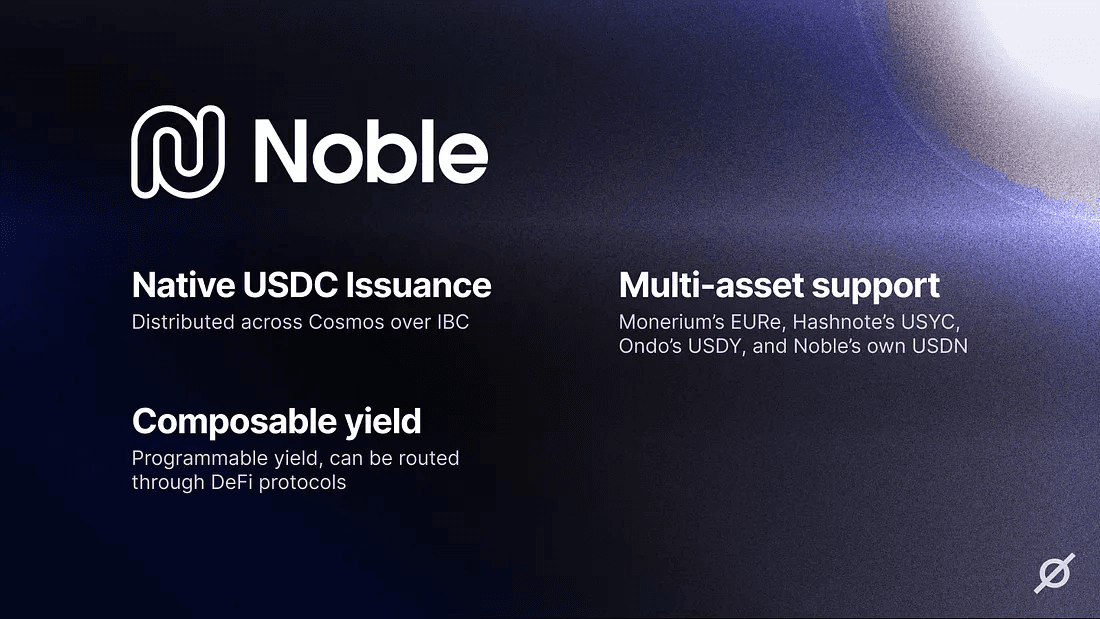

Noble — Cosmos’s Stablecoin Issuance Layer

What is Noble?

Noble is a purpose-built chain for stablecoin issuance in Cosmos. It was launched to give fiat-backed stablecoins a native home in the multichain world, starting with Circle’s USDC. Noble removes the need for bridges and wrapped assets by offering a direct mint-and-burn mechanism with Circle. Its mission has since expanded to onboarding multiple stablecoin issuers, including real-world asset (RWA)-backed products.

Here’s what it enables

- Regulated, native USDC issuance: USDC is minted and burned directly on Noble.

- Multi-asset support: Noble also issues Monerium’s EURe, Hashnote’s USYC, Ondo’s USDY, and Noble’s own USDN.

- Composable yield: Assets like USDY and USDN offer programmable yield that can be routed through DeFi protocols.

- IBC-native liquidity: Assets issued on Noble can be used seamlessly across all Cosmos chains.

Here are the metrics

- USDC minted via Noble: Over $425 million

- Active integrations: Osmosis, dYdX, Mars, and more use Noble-issued stablecoins for core liquidity

- Ecosystem growth: USDN launched in 2024 and has seen increasing integration in DeFi apps

Noble’s regulated issuance and composable design model make it the go-to issuance layer for stablecoins in Cosmos.

Ondo — Bridging TradFi and DeFi

What is Ondo?

Ondo Finance is a pioneer in real-world asset (RWA) tokenization. Their goal is to bring traditional financial products — like U.S. Treasuries — on-chain. Through a partnership with Noble, Ondo issues USDY and OUSG directly on Cosmos, as well as on its own native platform and upcoming Cosmos chain.

Here’s what it enables

- USDY: A yield-bearing stablecoin backed 1:1 by short-term U.S. Treasuries and deposits. Pays 4–5% APY.

- OUSG: A tokenized bond fund tied to Treasury ETFs. Floating value, ~4% APY, used as DeFi collateral.

- Composability: Both tokens integrate with Cosmos DeFi apps for savings, lending, and liquidity provision.

- Regulatory focus: USDY is offered to non-U.S. investors; OUSG is available on a permissioned basis for minting.

Here are the metrics

- RWA under management: Over $1B across USDY and OUSG

- Cosmos-native issuance: Via Noble, both tokens are IBC-compatible

- Use cases: Lending markets, DAO treasuries, LP positions, and institutional savings protocols

Ondo gives Cosmos access to battle-tested financial instruments with predictable, low-risk yield, bridging TradFi and DeFi. Working with Blackrock, Wellington Management, Goldman Sachs, and other TradFi industry giants, Ondo positioned itself at the epicenter of tokenization — bringing all sorts of stocks, bonds, and ETFs (i.e., onVISA / onTSLA).

Shade Protocol — A Privacy-Preserving, Basket-Pegged Stablecoin

What is Shade & SILK?

Shade Protocol is a suite of DeFi applications built on Secret Network, which focuses on data privacy. SILK is Shade’s flagship stablecoin — a privacy-preserving, overcollateralized stablecoin pegged to a basket of global currencies and commodities.

Here’s what it enables

- Privacy by default: Transactions are encrypted via Secret Network’s SNIP-25 standard

- Basket peg: SILK tracks a diversified index (USD, EUR, JPY, BTC, gold) to maintain global purchasing power

- Robust collateralization: Users mint SILK by depositing assets like wBTC, wstETH, stATOM

- DeFi ecosystem: SILK is used in ShadeSwap (private AMM), lending, and treasury tools

Here’s what they support

- Collateral types: ETH LSTs, BTC, ATOM, SCRT — all non-endogenous

- Active integrations: Secret Network dApps and growing Cosmos IBC footprint

- Use cases: DAO treasuries, hedging tools, privacy-focused payments and remittance.

SILK is uniquely positioned as Cosmos’s answer to the need for decentralized, inflation-resistant, and private stablecoins.

Pryzm — IBC Access to sUSDS from Sky on Ethereum (Formerly MakerDAO)

What is Pryzm?

Pryzm is a Cosmos-native yield protocol focused on unlocking the utility of interest-bearing tokens. In 2025, using IBC Eureka, it connected to MakerDAO’s upgraded stablecoin ecosystem (now known as Sky), introducing sUSDS — a yield-bearing version of USDS — to the Cosmos network.

Here’s what it enables

- Direct integration with Sky on Ethereum via IBC Eureka

- sUSDS = USDS + yield: sUSDS earns yield passively through the Sky Savings Rate

- Capital efficiency: sUSDS can be used in DeFi while still accruing base yield

- Roadmap includes: principal tokens, yield tokens, tranches, and more modular fixed-income tools

Here are the metrics

- Yield rate: ~4.5% APY from MakerDAO’s reserves (tokenized T-bills and DeFi loans)

- Cosmos usage: Supported in wallets like Keplr; expanding into lending protocols

- Ethereum scale: sUSDS backed by billions in reserves, now flowing into Cosmos

Pryzm enables Cosmos users to access one of Ethereum’s key decentralized stablecoins while preserving its yield.